.webp)

Sri Lanka to launch sovereign bond sale in International markets

COLOMBO (News 1st) - Bloomberg reports that Sri Lanka has launched a sale of 5 and 10 year sovereign bonds in international markets, for the second time in 2019. It adds that Citi, Deutsche Bank, HSBC, J.P. Morgan, SMBC Nikko, StanChart and BOC International are managing the sale.

Bloomberg News wires said initial price guidance was 6.60% for 5-year bonds and 7.8% for 10-year bonds. During the central bank’s monetary review in May, Officials said that the government was planning to sell approximately USD 2.5bn in bonds to finance cash flows in the 2019 budget. The latest issuance comes in the wake of a 2.4bn dollar bond issuance in March this year.

One can wonder how does this latest bond issuance stack up against Sri Lanka’s debt situation?

On the March this year, the Central Bank issued USD 1bn of 5-year bonds at 6.85% and a USD 1.4bn 10-year Fixed Rate Bonds with maturity dates in March 2024 and March 2029, respectively. Following the bond issuance in March, the government was criticized for issuing ISB’s at interest rates higher than several regional countries, while certain politicians requested increased transparency in the bond issuance process.

The sovereign bonds issued in March this year marked Sri Lanka’s thirteenth USD benchmark offering in the international bond markets since 2007. At an estimated 83 % of its Gross Domestic Product, Sri Lanka’s central government debt level is high. As the country approached upper-middle-income status, it has been borrowing on more commercial terms with increased cost and risk.

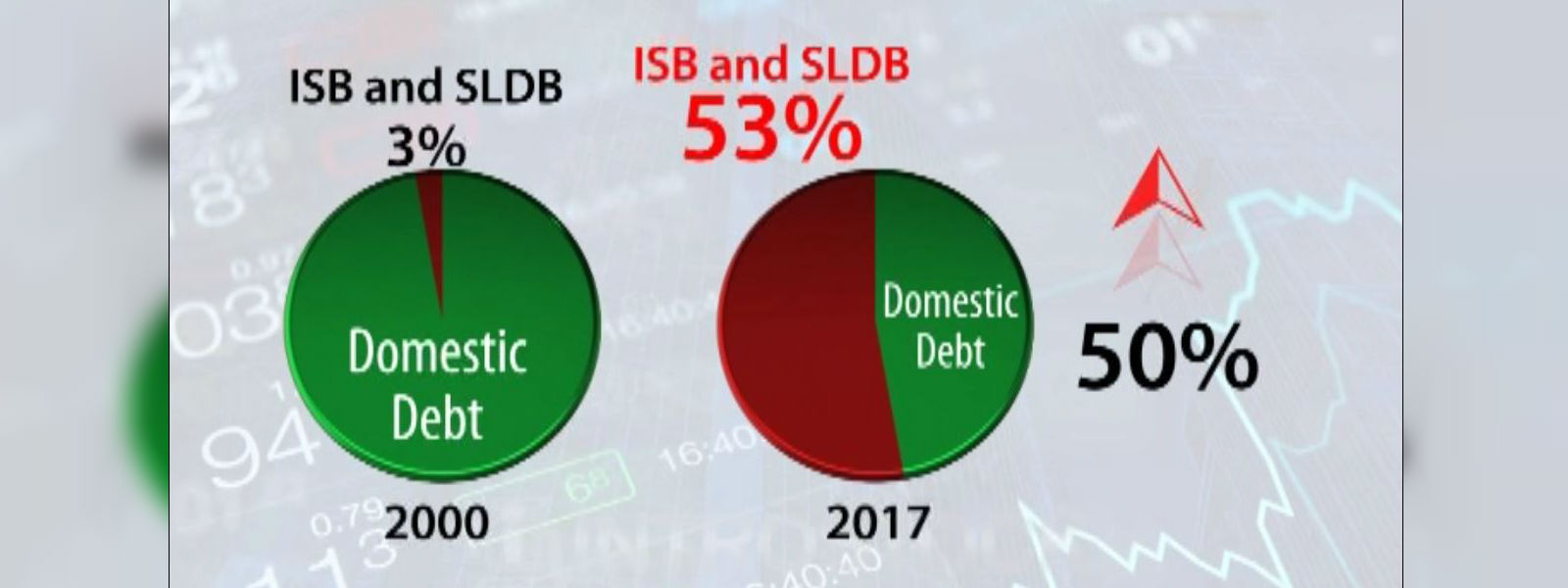

The majority of foreign currency denominated debt is now largely made up of market borrowings including International Sovereign Bonds and Sri Lanka Development Bonds which in 2017 accounted for 53%, up from just 3% of total foreign currency denominated debt in 2000.

According to the World Bank, in total, maturities of bullet repayments on Eurobonds from 2019 to 2023 and from 2025 to 2028 alone will amount to USD 12.15bn. The World Bank noted that this is new territory for the country and could expose the island nation to refinancing risks.

While the government has adopted policies designed to address these risks, the slow progress of key structural reforms remains a cause for concern. The central government debt to GDP ratio increased to 82.9% at the end of 2018 from 76.9% in 2017. The total outstanding central government debt stock increased by 16.1% to approximately Rs. 11.9 trillion at the end of 2018. Total debt service payments in 2018 amounted to Rs. 2 trillion, a substantial increase of 30.3% in comparison to Rs. 1.6 trillion in 2017.

Last week the cabinet approved to raise up to a maximum of Rs. 480bn for government debt repayment in 2019 under the active liability management act. The main contributors to the steady increase in government debt can be identified as the continuous and increasing budget deficit and the increase in borrowings.

Last week, the government sought approval for a supplementary estimate of Rs. 5.6bn, in parliament last week for expenses that included vehicles for several ministries and for the renovation of a minister's official residence.

Other Articles

Featured News

.png )

-787893_550x300.jpg)

-787887_550x300.jpg)

-785316_550x300.jpg)

.gif)