.webp)

CBSL accepts only Rs. 10 Bn, after offering Rs. 45 Bn in T-Bills

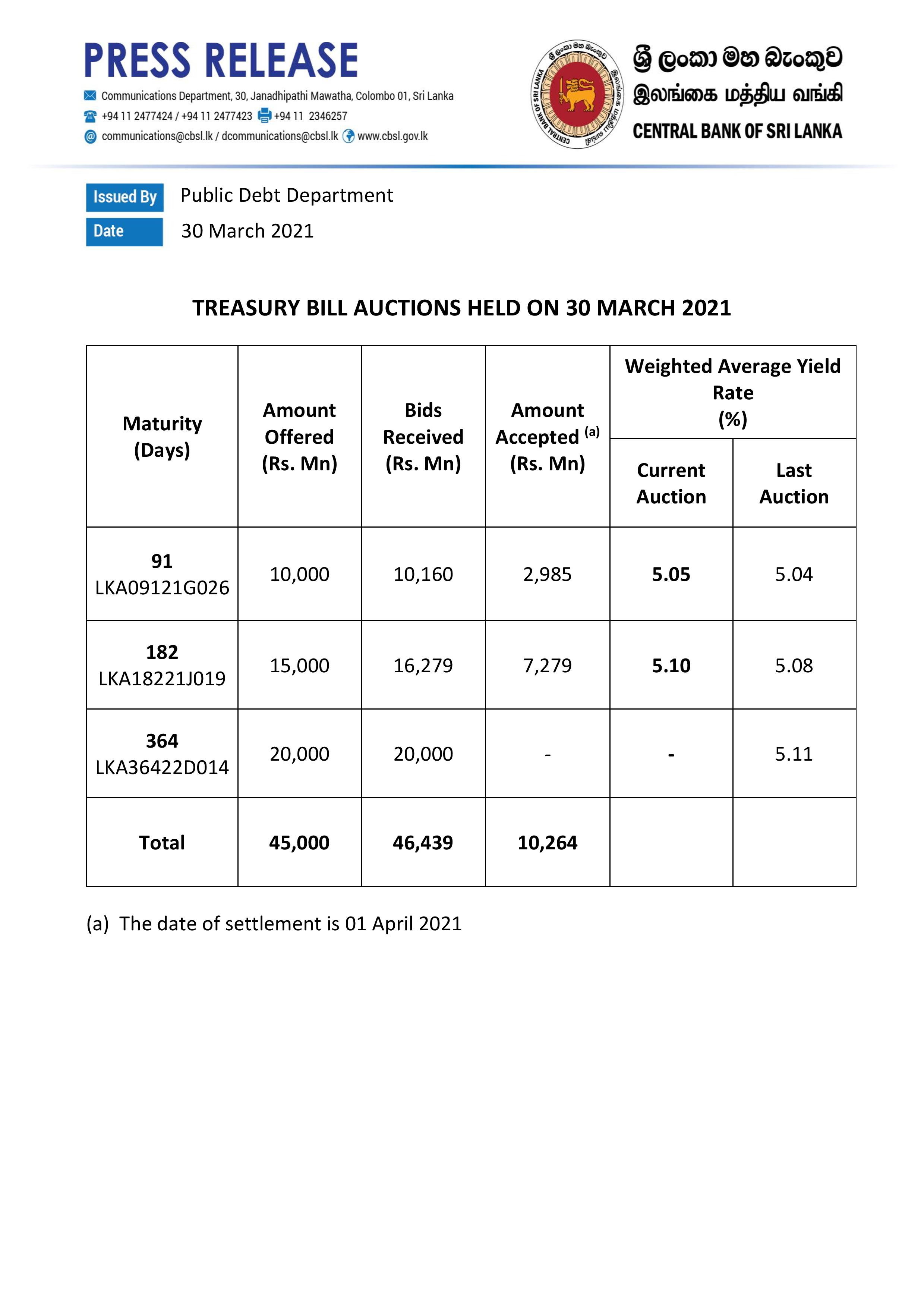

Colombo (News 1st); The Central Bank of Sri Lanka had failed to sell 77 percent of Treasuries offered at the 30th March Treasury Bill Auction, while a sharp rise in interest rates was also observed.

The Treasury Bill auction was held on Tuesday (30) to secure short-term loans of Rs. 45 Billion required by the government. Rs. 10 Billion was offered for a 91 day maturity period, Rs. 15 Billion was offered for a 182-day maturity period and Rs. 20 Billion was offered for a 364-day maturity period, said the Central Bank. With a total of Rs. 45 Billion offered, the Central Bank had only accepted Rs. 10 Billion in Treasury Bills.

Other Articles

Featured News

.png )

-786108_550x300.jpg)

-786102_550x300.jpg)

-785316_550x300.jpg)

.gif)