.webp)

CBSL to maintain policy rates at current levels

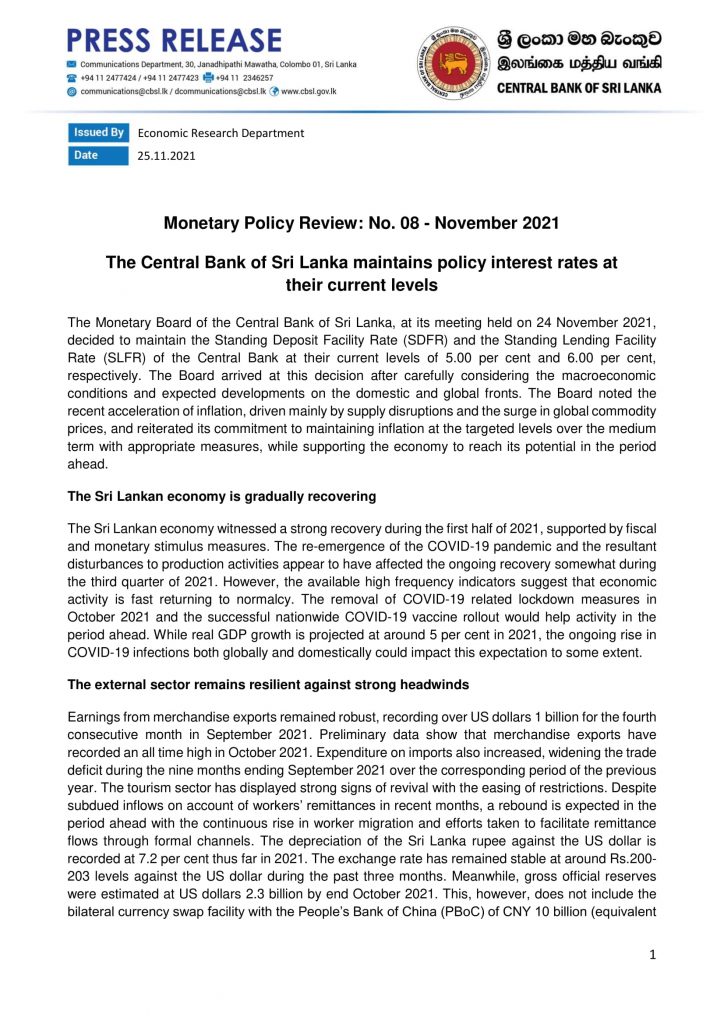

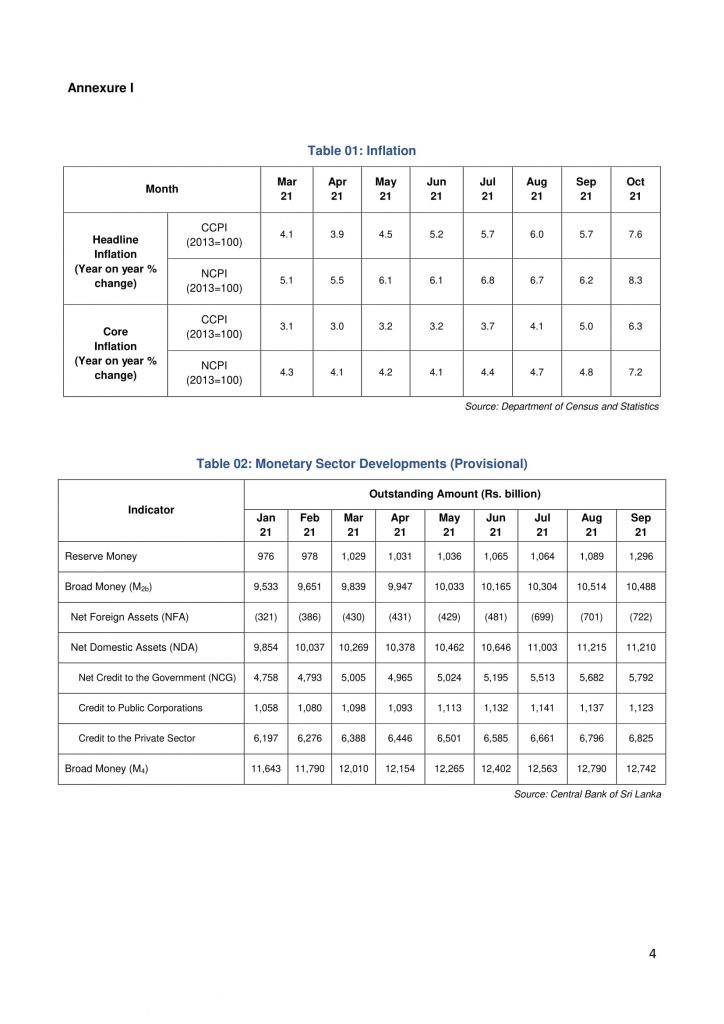

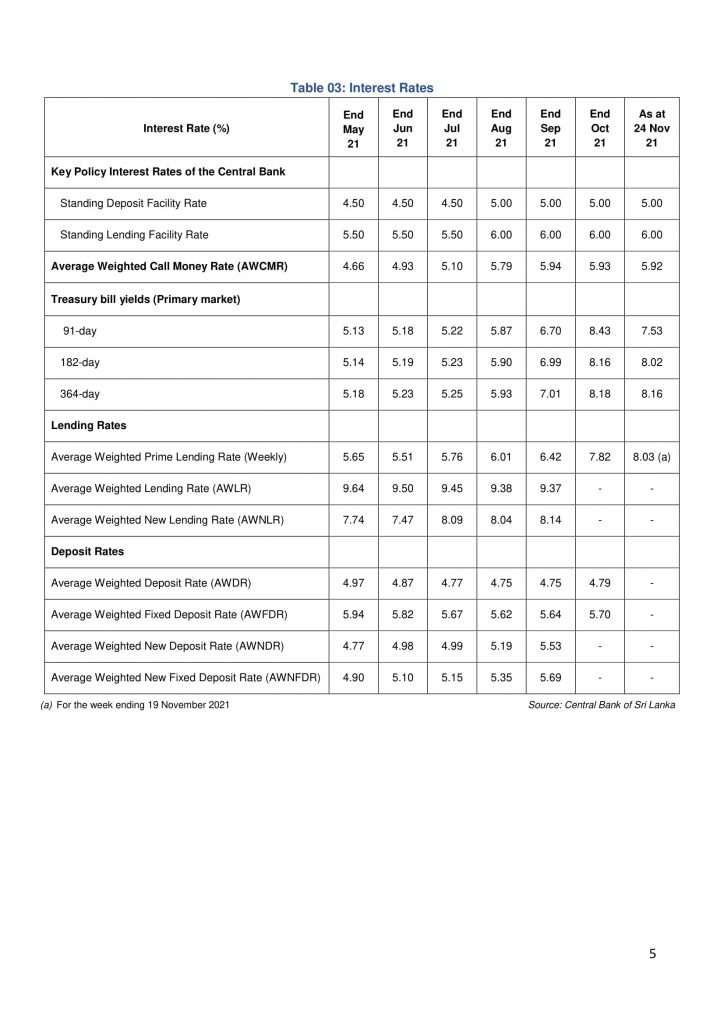

COLOMBO (News 1st); The Monetary Board of the Central Bank of Sri Lanka (CBSL) has decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) at their current levels of 5.00% and 6.00% respectively.

Issuing a press release, the CBSL states that the board arrived at this decision after considering the macroeconomic conditions and expected developments on the domestic and global fronts, in addition to the recent acceleration of inflation, driven mainly by supply disruptions and the surge in global commodity prices, and reiterated its commitment to maintaining inflation at the targeted levels over the medium term with appropriate measures, while supporting the economy to reach its potential in the period

ahead.

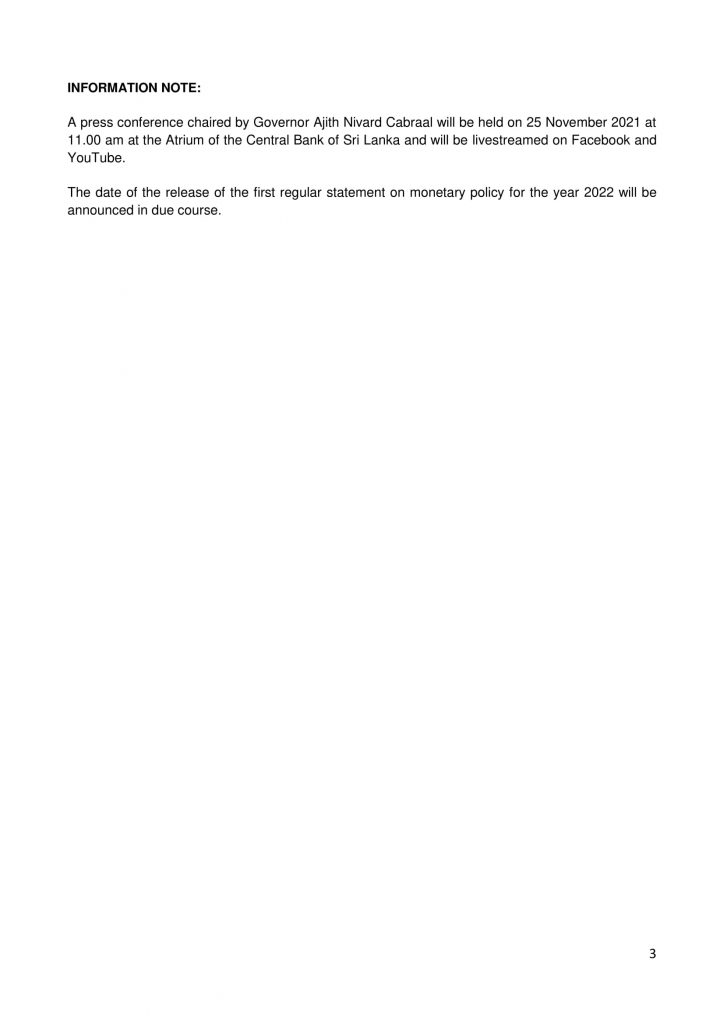

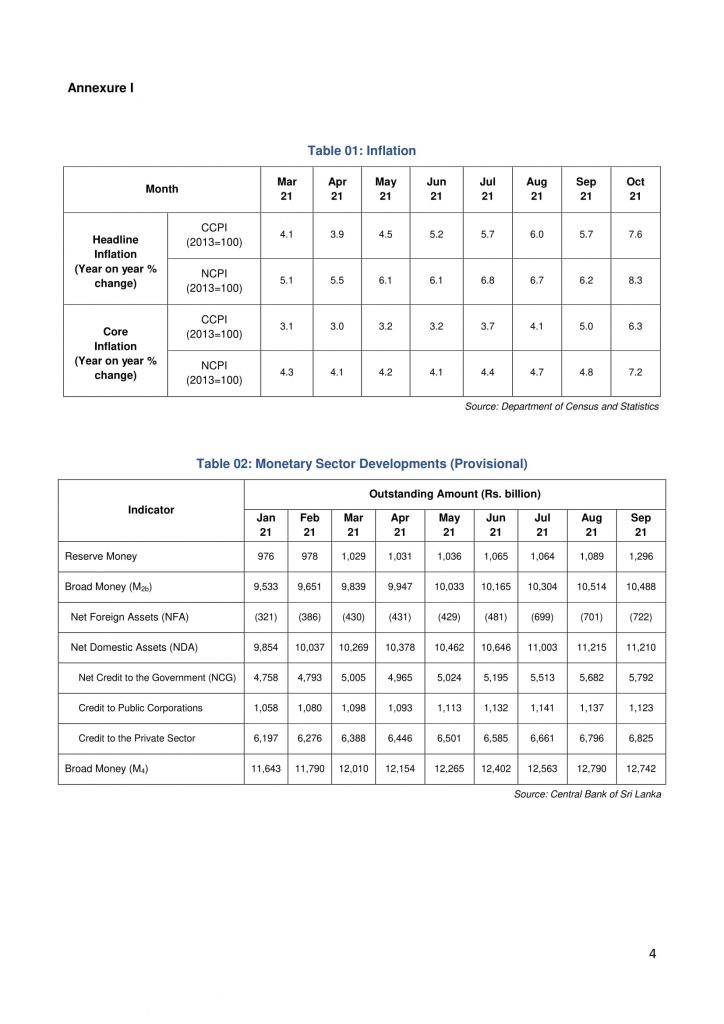

While stating that the economy is impacting whilst the re-emergence of COVID-19 in the country could tamper it, the CBSL states that the external sector remains resilient, the market interest rates have increased, reflecting the passthrough of tight monetary conditions, and further states that inflation accelerated recently mainly due to supply side disturbances and the surge in

commodity prices internationally.

Other Articles

Featured News

.png )

-819380_550x300.jpg)

-812087_550x300.jpg)

-810262_550x300.jpg)

.gif)